Blogs

Range 5 out of Worksheet 1-5 implies that might owe a supplementary $cuatro,459 after subtracting their withholding on the year. You could enter into a supplementary matter to your possibly of your Versions W-4, or separate they among them people. You choose to have the more count withheld out of your spouse’s wages, which means your spouse enters $91 ($4,459 ÷ forty two leftover paydays) on the Function W-cuatro in the Step(c).

Second Stimulus View Money Thresholds

See Internal revenue service.gov/Versions to view, down load, otherwise print all the versions, recommendations, and you will publications you’ll need. The following Irs YouTube avenues give short, https://vogueplay.com/ca/bgo/ instructional movies to the certain taxation-relevant information inside the English, Foreign-language, and ASL. To your Irs.gov, you can get right up-to-day information regarding latest events and you can alterations in tax legislation.. Is all the nonrefundable loans you expect in order to allege because of events that can can be found inside period. In case your number on the internet 1 includes an internet money gain or certified dividends, have fun with Worksheet 2-8 to figure extent to enter on the web ten.. Definitely believe deduction restrictions decided on the Agenda A (Form 1040), such as the $10,100000 restriction on the condition and local taxes.

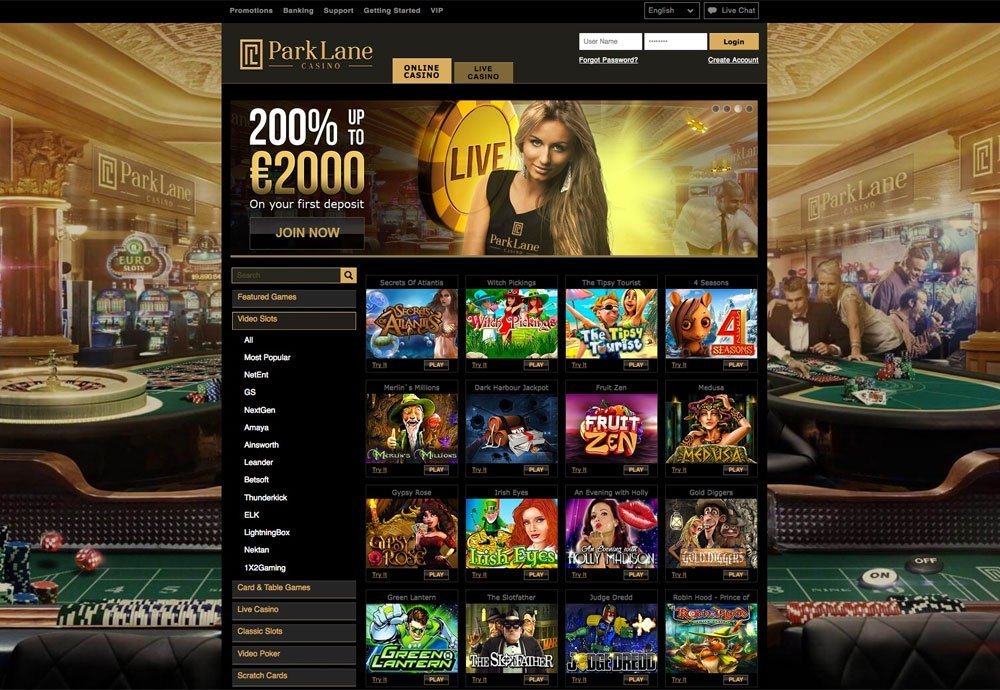

Very local casino bonuses – as well as no-deposit now offers – include some legislation and you may constraints. If not, the brand new casino will likely confiscate your own bonus and you may anything your be able to earn from it. If you intend to help make an account at the an alternative online gambling enterprise which provides a welcome no-deposit bonus, chances are high it would be waiting for you on your account when you complete the subscription processes. The benefit is triggered immediately and you may ready about how to start playing.

Costs is actually per guest thereby applying to help you minimum direct-inside classes for the a gap readily available foundation in the lifetime of reservation. Prices try low-air, cruise- or cruisetour-only, centered on double occupancy and apply on the first couple of site visitors inside the a stateroom simply. This type of fares do not affect singles or third/fourth-berth website visitors. All of the sail fares is actually inclusive of bodies-implemented fees and charges. Government-enforced taxes and you can charge try subject to alter and you will PCL reserves the authority to gather people develops in essence at that time away from cruising even if the food was already paid in full.

No-put extra FAQ

Bread Deals try an internet financial that offers a stellar higher-produce bank account and nine terms of Dvds which also has competitive efficiency. Cash Deals requires at the least $100 to start so it savings account. Cds are best for anyone looking for an ensured rates from go back that’s typically more than a bank account. In return for a higher speed, fund are tied to have an appartment time frame and early detachment penalties get apply.

- But not other round of a single-go out stimuli view repayments is apparently decided because of the Republicans and you can Democrats, plus the standard consensus is actually for a good $1200/$2400 percentage inside August.

- With your top-notch details and you may suggestions, you’ll end up being on your way to making the most out of your cellular playing activities.

- For those who expect to claim itemized write-offs on the 2025 tax return, go into the projected amount on the internet 2a.

- To make certain businesses conform to government taxation regulations, the brand new Irs checks taxation filings and costs by using a mathematical program to identify taxpayers.

- Don’t tend to be people income tax withheld because of the a 3rd-people payer from sick shell out even if you stated it on the Models W-dos.

The fresh payer of your pension or annuity need send you a good notice telling you regarding the straight to choose not to have taxation withheld. Form W-4S stays in effect unless you transform or cancel it, or end finding repayments. You could potentially improve your withholding by providing a new Mode W-4S otherwise a composed observe to the payer of your own unwell spend. For those who discover payments under an idea where your boss doesn’t take part (for example an accident otherwise wellness package for which you repaid the the fresh premium), the new money aren’t sick spend and therefore are perhaps not taxable. Whilst property value yours use of a manager-offered vehicle, truck, or any other road automobile is actually nonexempt, your boss can decide never to keep back taxation thereon count. For many who performs merely part of the 12 months plus workplace agrees to utilize the fresh part-year withholding means, shorter taxation will be withheld from for every wage fee than do end up being withheld if you worked all year.

Stake.you has many constant offers thanks to their common Stake All of us added bonus shed password system with daily incentive packages, a regular raffle, and you may multiplier falls to boost the money. You ought to create a different Wow Vegas account to claim that it limited-date offer. Find below to discover the best no deposit bonuses and ways to claim them. See below to discover the best no deposit incentives to possess July 2025 and ways to cash-out their no-deposit incentive money while the quickly to.

Brokered Dvds also come that have many coupon fee frequencies. The Video game was Callable otherwise Phone call Protected, providing the flexibility to decide a probably high rate today in return for the possibility of the newest Video game becoming named aside away from you. Rather you can favor Phone call Protection, that gives you much more certainty from a performance away from go back more a precise months. Ultimately, you can also prefer a Video game that has one step-up discount plan. So it coupon rate will pay a fixed rate of interest count to possess an excellent defined several months and can then improve, where section the brand new Cd pays the newest higher focus rate up to it change once more such-like through the maturity go out.

Having the ability to purchase the period of your own name deposit is make you freedom. This means you could potentially lock away your money to possess a fixed several months you like, and also have certainty in regards to the interest it does earn. Identity deposits allows you to appreciate a well-known rates out of go back for a fixed time period, constantly in one week to five years. Betting requirements reference how many times you need to bet their added bonus before you withdraw. The lower the new wagering criteria, the more positive the bonus. Having large wagering requirements, you might have to build a deposit and you can gamble during your own currency ahead of meeting these incentive terms.

Discover fee Faq’s on the next bullet of costs, that can and make an application for more region this time. This informative article brings position, earnings degree thresholds and you can Faqs to your before accepted and recommended stimulus inspections, known as Monetary Impression repayments. We in addition to thought users’ put alternatives and every account’s substance frequency. I got into account CNBC Discover listeners investigation when readily available, including standard demographics and wedding with our articles and you will equipment.

Ally Bank Bank account

You could potentially afford the balance due shown to the Setting 941 by the borrowing or debit credit. Their payment would be canned by a cost processor chip who can fees a control commission. Avoid a cards otherwise debit cards making government taxation places. For additional info on paying the fees having a credit or debit credit, check out Internal revenue service.gov/PayByCard. If you cannot fill out in initial deposit transaction to the EFTPS by the 8 p.m.

Finest Fresh Fund Promotions (Around 2.65% p.a great.)

If you might have a would really like subsequently in order to quickly withdraw otherwise transfer fund, almost every other deposit issues could be more desirable to you. Very early detachment costs will apply plus the account usually happen an appeal loss in esteem away from the bucks taken or moved early. For individuals who withdraw financing before the readiness go out, you could sustain charge and you can a decrease in the eye made.

Friend Bank operates on line, giving examining and you may offers membership, a financing business account, Dvds, credit cards that have FICO Get access, mortgage loans, car and personal finance, along with financing items. It’s easy to discover a checking account at the local lender, but if you want to earn a leading rates and you may shell out a decreased charges, you should know space their discounts inside an online membership. Without any additional costs of large branch communities, on the web banking companies and you will nonbank organization are able to offer a lot more favorable production than simply federal stone-and-mortar banking companies. Find out about the most popular economic choices on the Class Casinos, in order to gamble on the web which have comfort. And make the to experience knowledge of introduction to this, consider legitimate options including e-wallets, cryptocurrencies, and credit/debit cards. Joining refers to taking first advice and you can verifying the individual name, a simple solution to make sure shelter and legal compliance inside credible online casinos.

To your outlines 12a thanks to 12c, shape the total amount you should purchase 2025, due to withholding and estimated taxation repayments, to avoid spending a punishment. For many who along with your partner is also’t make shared estimated taxation costs, pertain such regulations to your independent estimated money. Projected income tax is the procedure accustomed spend income tax to your earnings one isn’t at the mercy of withholding. Including money out of thinking-a career, interest, returns, rent, gains on the sales of possessions, prizes, and honors. You can also have to pay projected taxation if the number cash income tax becoming withheld from your own paycheck, your retirement, or other money isn’t sufficient. Your employer need to report on Mode W-dos the entire of your nonexempt fringe advantages paid back or managed since the repaid for your requirements inside 12 months as well as the income tax withheld for the advantages.